https://ad.doubleclick.net/ddm/clk/603380685;411205025;u;gdpr=$%7BGDPR%7D;gdpr_consent=$%7BGDPR_CONSENT_755%7D?https://www.capitalonecareers.com/tech?source=rd_builtin_job_posting_tm&utm_source=builtin.com&utm_medium=job_posting&utm_campaign=Tech&utm_content=niche_site&utm_term=411205025&ss=paid

Responsible for executing risk-based compliance transaction and control testing, analyzing data, and collaborating with business partners on test results. Requires excellent analytical skills, communication, and attention to detail.

161 Bay Street (93021), Canada, Toronto,Toronto, Ontario,

Sr. Associate, Compliance

About Capital One Canada.

For over 20 years, we've been on a mission to change banking for good and build relationships by making credit accessible, simple, intuitive and rewarding. We want to help Canadians succeed with credit, because we believe in people - in our customers, in our associates, and in talent like you!

About The Team

Canada Compliance is a second line of defense function responsible for monitoring and assessing regulatory compliance risk for Capital One Bank (Canada Branch) in accordance with Capital One's risk management framework. The Compliance Testing team is responsible for executing risk-based compliance transaction and control reviews of business processes to independently validate business line adherence to applicable Canadian laws, regulations, and regulatory guidance.

About the Role

The Canada Compliance team is seeking an experienced Senior Compliance Testing Associate who will be responsible for executing risk-based compliance transaction and control testing under the leadership of the Compliance Testing Manager.

A successful candidate enjoys developing a deep understanding of the regulatory requirements and conducting monitoring/testing and drawing conclusions based on critical thinking, judgment and analysis to validate adherence. The role requires the ability to work cross-functionally with both business partners and Compliance advisors and the ability to work autonomously. In addition, this role requires great attention to detail and excellent verbal and written communication skills.

Your Responsibilities

Responsibilities include (but may not be limited to):

The right candidate will have:

Basic Qualifications:

Preferred Qualifications:

Working at Capital One.

Enjoy a hybrid work environment, with 3 days in the office. Build a comfortable workspace with our one-time, Work From Home allowance and enjoy our head office located conveniently across the street from Union Station.

Live well-physically, financially and emotionally. Receive support for you and those who are most important to you, with full coverage for spouses, domestic partners, and dependents. With up to $3000 in mental health coverage and up to $5000 in tuition subsidies per year-and much more-you'll discover that Capital One is committed to helping you live your best life.

We may use your information for automated decision making. We may, for certain purposes, render a decision based exclusively on automated processing of your personal information as a part of the candidate screening process.

Capital One Canada is an equal opportunity employer committed to fostering a diverse and inclusive work environment. We consider all qualified applicants and will meet the needs of those requiring reasonable accommodations.

If you have visited our website in search of information on employment opportunities or to apply for a position, and you require an accommodation, please contact Capital One Recruiting at 1-800-304-9102 or via email at [email protected] . All information you provide will be kept confidential and will be used only to the extent required to provide needed reasonable accommodations.

For technical support or questions about Capital One's recruiting process, please send an email to [email protected]

Capital One does not provide, endorse nor guarantee and is not liable for third-party products, services, educational tools or other information available through this site.

Capital One Financial is made up of several different entities. Please note that any position posted in Canada is for Capital One Canada, any position posted in the United Kingdom is for Capital One Europe and any position posted in the Philippines is for Capital One Philippines Service Corp. (COPSSC).

Sr. Associate, Compliance

About Capital One Canada.

For over 20 years, we've been on a mission to change banking for good and build relationships by making credit accessible, simple, intuitive and rewarding. We want to help Canadians succeed with credit, because we believe in people - in our customers, in our associates, and in talent like you!

About The Team

Canada Compliance is a second line of defense function responsible for monitoring and assessing regulatory compliance risk for Capital One Bank (Canada Branch) in accordance with Capital One's risk management framework. The Compliance Testing team is responsible for executing risk-based compliance transaction and control reviews of business processes to independently validate business line adherence to applicable Canadian laws, regulations, and regulatory guidance.

About the Role

The Canada Compliance team is seeking an experienced Senior Compliance Testing Associate who will be responsible for executing risk-based compliance transaction and control testing under the leadership of the Compliance Testing Manager.

A successful candidate enjoys developing a deep understanding of the regulatory requirements and conducting monitoring/testing and drawing conclusions based on critical thinking, judgment and analysis to validate adherence. The role requires the ability to work cross-functionally with both business partners and Compliance advisors and the ability to work autonomously. In addition, this role requires great attention to detail and excellent verbal and written communication skills.

Your Responsibilities

Responsibilities include (but may not be limited to):

- Under the leadership of the Testing Manager, lead and/or provide support in the planning of test strategies and execute targeted transactions and controls testing for Canadian regulatory compliance requirements

- Manage testing schedules to ensure all tasks and reporting are completed within established timeframes

- Analyze data from multiple sources and systematically documenting the work and results

- Develop new ways to test large populations of data

- Reviewing transactions and controls tests executed by peers for accuracy and adherence to test procedures

- Establishing and maintaining strong relationships with business partners and Compliance advisors

- Collaborate with and lead discussions with business partners on test results, including issues and recommendations identified to ensure test results are well-grounded

- Assisting in communicating results to the business areas and Compliance senior management, as needed

- Demonstrate ability to explore and quickly grasp new technologies to progress varied initiatives

- Participate in, lead, and/or execute other Compliance risk management initiatives for the team as assigned

- Keep current on Compliance risk management trends, best practices and guidelines issued by applicable regulatory bodies and the industry

The right candidate will have:

- The ability to distill complex information into a clear and concise narrative

- The ability to organize, prioritize, and manage multiple projects and deliverables

- Solid analytical and investigative skills

- A proven track record in driving high quality and timely results

- The ability to work autonomously in a dynamically changing environment

- Demonstrated business maturity with the ability to effectively communicate and influence stakeholders within all levels of the organization, establish and maintain positive relationships

- Solid interpersonal and conflict resolution skills

- Exercises strong judgment and knows when to escalate with appropriate stakeholders before issues arise

Basic Qualifications:

- At least 3 years of financial consumer compliance monitoring experience or 3 years of consumer compliance auditing experience or 3 years of experience in assessing processes and their controls, or 3 years of experience in assessing third parties and vendors

- Experience working in a regulated Canadian financial services organization or other highly regulated industry

- Scripting experience in (Python, SQL)

Preferred Qualifications:

- At least 5 years of financial consumer compliance monitoring experience or 5 years of consumer compliance auditing experience

- Familiarity with applicable Canadian regulators (OSFI, OPC, FCAC) and regulations that apply to a credit card business or other financial products

- Relevant certification or accreditation in Compliance, Risk Management, Legal, or other related fields

- Strong problem-solving and conceptual thinking skills

- Strong communication skills

- Experience creating effective presentations

- Working knowledge of AI in the workplace

- Working knowledge of basic statistics

- Working knowledge of cloud data structure (snowflake)

- Experience creating test scripts using SQL/Python to test full populations for key attributes

- Working knowledge of French language

Working at Capital One.

Enjoy a hybrid work environment, with 3 days in the office. Build a comfortable workspace with our one-time, Work From Home allowance and enjoy our head office located conveniently across the street from Union Station.

Live well-physically, financially and emotionally. Receive support for you and those who are most important to you, with full coverage for spouses, domestic partners, and dependents. With up to $3000 in mental health coverage and up to $5000 in tuition subsidies per year-and much more-you'll discover that Capital One is committed to helping you live your best life.

We may use your information for automated decision making. We may, for certain purposes, render a decision based exclusively on automated processing of your personal information as a part of the candidate screening process.

Capital One Canada is an equal opportunity employer committed to fostering a diverse and inclusive work environment. We consider all qualified applicants and will meet the needs of those requiring reasonable accommodations.

If you have visited our website in search of information on employment opportunities or to apply for a position, and you require an accommodation, please contact Capital One Recruiting at 1-800-304-9102 or via email at [email protected] . All information you provide will be kept confidential and will be used only to the extent required to provide needed reasonable accommodations.

For technical support or questions about Capital One's recruiting process, please send an email to [email protected]

Capital One does not provide, endorse nor guarantee and is not liable for third-party products, services, educational tools or other information available through this site.

Capital One Financial is made up of several different entities. Please note that any position posted in Canada is for Capital One Canada, any position posted in the United Kingdom is for Capital One Europe and any position posted in the Philippines is for Capital One Philippines Service Corp. (COPSSC).

Top Skills

Python

Snowflake

SQL

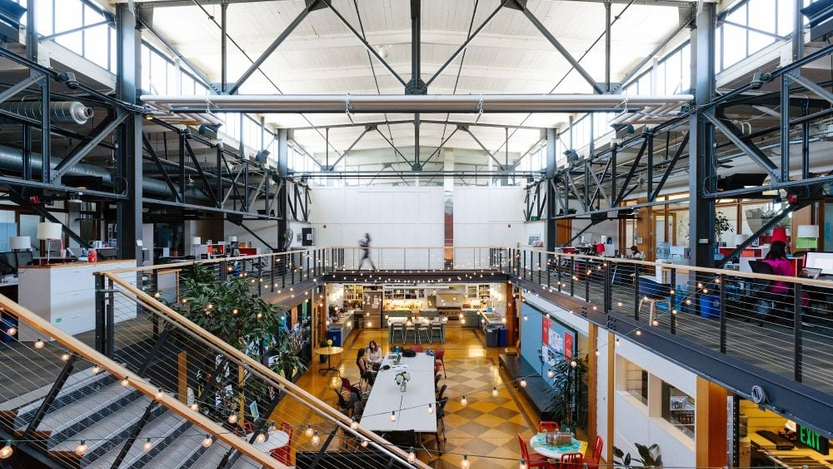

Capital One San Francisco, California, USA Office

Located in the South of Market district, our San Francisco office has everything you need for a flexible work environment. Associates in the office have easy access to public transportation, plenty of restaurants and spacious and comfortable work spaces.

Similar Jobs at Capital One

Fintech • Machine Learning • Payments • Software • Financial Services

Analyze market trends, support business strategy development, build financial models, and collaborate with teams on product pricing strategies.

Top Skills:

PythonQuicksightSQLTableau

Fintech • Machine Learning • Payments • Software • Financial Services

Lead a team of mobile engineers to create native mobile apps, focusing on architecture, innovation, and team development while embracing agile methodologies.

Top Skills:

AndroidAWSGCPiOSAzure

Fintech • Machine Learning • Payments • Software • Financial Services

Manage operations of legal Third Party Vendors, ensuring quality performance and exceptional customer experience while leading projects and data-driven recommendations.

Top Skills:

LeanSix SigmaSQLTableau

What you need to know about the San Francisco Tech Scene

San Francisco and the surrounding Bay Area attracts more startup funding than any other region in the world. Home to Stanford University and UC Berkeley, leading VC firms and several of the world’s most valuable companies, the Bay Area is the place to go for anyone looking to make it big in the tech industry. That said, San Francisco has a lot to offer beyond technology thanks to a thriving art and music scene, excellent food and a short drive to several of the country’s most beautiful recreational areas.

Key Facts About San Francisco Tech

- Number of Tech Workers: 365,500; 13.9% of overall workforce (2024 CompTIA survey)

- Major Tech Employers: Google, Apple, Salesforce, Meta

- Key Industries: Artificial intelligence, cloud computing, fintech, consumer technology, software

- Funding Landscape: $50.5 billion in venture capital funding in 2024 (Pitchbook)

- Notable Investors: Sequoia Capital, Andreessen Horowitz, Bessemer Venture Partners, Greylock Partners, Khosla Ventures, Kleiner Perkins

- Research Centers and Universities: Stanford University; University of California, Berkeley; University of San Francisco; Santa Clara University; Ames Research Center; Center for AI Safety; California Institute for Regenerative Medicine