San Francisco-based fintech platform Secfi announced Tuesday that it raised $150 million in fresh financing by way of Serengeti Asset Management. The latest raise marks the second investment the firm has made in the company, the first of which was announced in January of 2020. The new financing will be used to expand the platform to include stock option financing for executives and employees from late-stage startups ready to exit.

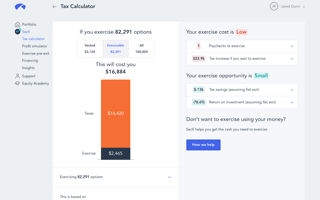

Secfi’s pre-wealth management platform aims to help startup employees better manage their equity compensation. The company’s payout forecasting and tax modeling tools help employees figure out when and how much it would cost to exercise their stock options in the event that their company goes public.

The company’s financing structure covers exercise costs and taxes which allow for employees to participate in their employer’s success without putting their savings at risk, according to the company. Employees aren’t required to submit payments against the financing until an IPO, SPAC or other liquidity event.

“While exercising early is the ideal situation, we have seen a 5x surge of late-stage employees coming to Secfi to explore financing options before IPO and decided to expand our pool of capital to better meet their needs and accelerated timelines,” Frederik Mijnhardt, CEO of Secfi, said in a statement.

Secfi has registered over $10 billion worth of startup stock options on its platform, according to the company.

“The recent increase in SPAC activity has underscored the need for employees to early exercise,” Leslie D. Biddle, partner and president of Serengeti, said in a statement. “We’re excited to further scale the platform to meet this growing demand.”

The pre-wealth management platform has worked with employees from some of last year’s biggest IPOs and SPAC exits, including Airbnb, DoorDash and Snowflake.

Secfi has raised $707 million in venture capital financing to date, according to Crunchbase.